In this blog, we’re going to outline a few tips to help you have a hassle-free end of year.

If your business has fairly simple bookkeeping, then your main focus should be on record keeping.

How to register to pay tax

If you’re doing a return for the first time, the easiest way to do this is by registering for Self Assessment on the government website. This will allow you to file your tax return online.

To get started, you'll need a Unique Tax Reference (UTR). Once you’ve registered, you will receive this in the post, together with your activation code. Save your UTR in a safe place, you’ll need it every time you file a return.

What records to keep

You’ll have to keep records of your business income and expenses for your tax return. Being a sole trader, you’ll also need to keep a record of all your personal income because there isn’t any legal difference between what’s considered yours and what you’ve earned from your business like there is if you are registered as a limited company.

You’ll need to keep complete records of:

All sales and income

All business expenses

VAT records, if you’re registered for VAT

PAYE records, if you employ people

In practice this means you’ll need to keep:

All receipts for goods and stock

Bank statements

Sales invoices

Purchase invoices

Any other evidence that proves a transaction took place, relating to your income and expenditure

You’ll use these records to work out your profit and loss for your tax return.

What business expenses are tax-exempt?

When calculating your profit you can deduct the expenses required to run your business from your income. This is how you’ll derive your taxable profit. Some examples of business expenses include:

Office costs like stationery, internet or phone bills

Travel costs like fuel, parking or transport

Staff costs like salaries or subcontractor costs

Stock or raw materials you buy to sell on

Finance costs such as insurance or bank charges

Premises or rent

Advertising or marketing costs like your website hosting

Training or development related to your business, like a refresher course

Subscription costs like software

If you’re unsure of what you can claim, you can always contact the Government Self Assessment helpline to check if a business cost is an allowable expense.

How long should I keep my records?

You must keep records for five years from the end of the tax year they relate in case HMRC asks to see them. You might even have to keep them longer if:

They show a transaction that covers more than one financial tax period

The business has bought something that it expects to last more than 5 years, like equipment or machinery

You sent your tax return late

HMRC has started a compliance check into your tax return

While you’re obliged to keep records, when it comes to submitting your tax return, you don’t send these records.

How should I keep these records?

HMRC doesn't mandate how records should be kept. Some people choose to keep them on paper or spreadsheets, while others keep them digitally, in their bank account or as part of their accounting software.

At Mettle, we believe keeping digital records makes the end-of-year process much easier. To help this, we suggest setting up a separate bank account for your business from your account. This way it's clear what relates to the business and what doesn’t.

While you don’t have to put all transactions that relate to your business through a single account, it tends to make it simpler to record everything in a single place, otherwise, when it comes to the end of the year, you might miss something you’ve paid for in cash or on a personal card.

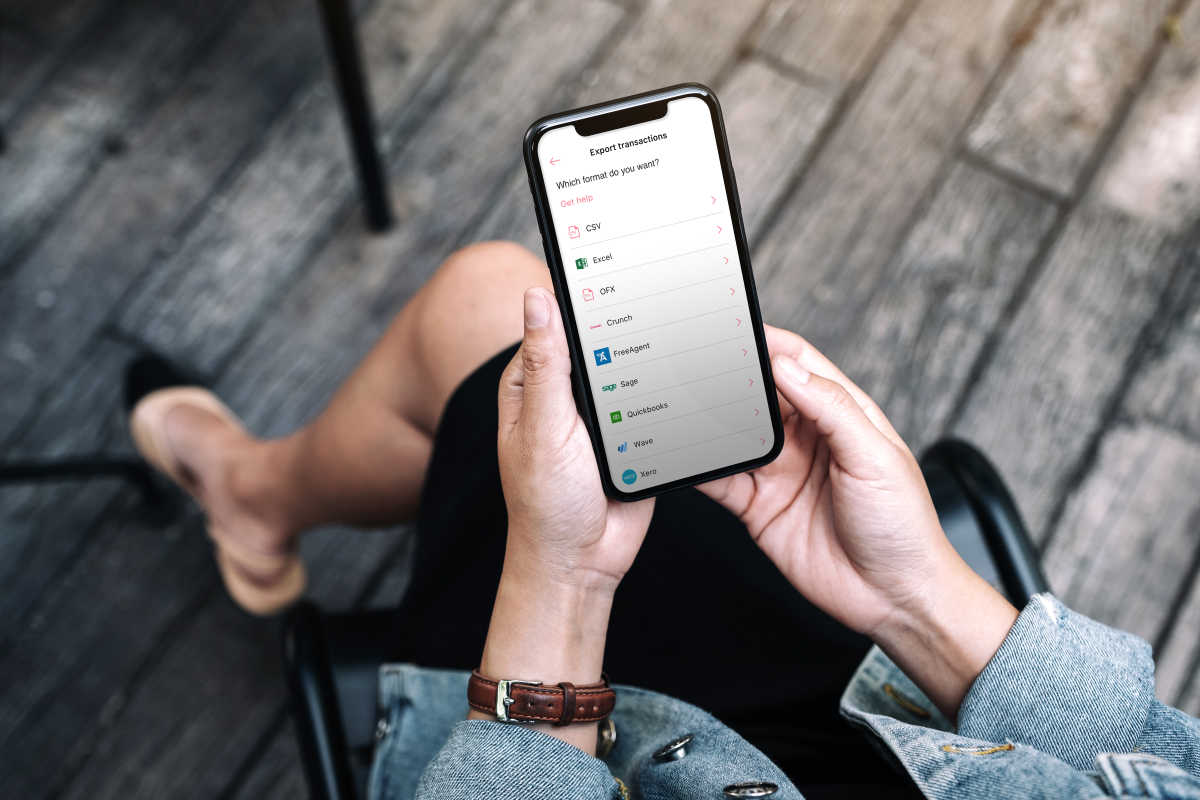

Accounts like Mettle have features that give you the ability to categorise your transactions, helping you classify what is income and what’s an expense as the transaction happens, straight from your app. If you don’t do it in real-time, we remind you under our “Tasks” tab to do it later. This helps you know exactly where you stand with your businesses income and expenses.

Categorising expenses, capturing images of receipts and payables as well as raising and tracking sales invoices is likely to give you a full view of your income and expenses in as close to real-time as possible. If you do this throughout the year, it will make the final entry into the Self Assessment form pretty straightforward.

After you've completed those tasks, and synced your Mettle account with FreeAgent, you can get a view of how much tax you're likely to owe with the tax calculation in the Mettle app. You can then set money aside in Money pots to save for your tax return.

How do I enter this information into HMRC?

We recommend filing your tax online, or through software, such as FreeAgent, however, there are paper options if you prefer, you can find out more information about them here.

When it comes to 5 April, (which is the government tax year-end) if you’ve registered for an online Self Assessment when you started your business, and manage your income and expenses throughout the year, you should be in a good place to breeze through the Self Assessment process.

Here are the next steps to filing:

As your submission will include both your business income and any other personal income you have received in that financial year, make sure you have all the information to hand, this includes:

Your P60 and payslips if you’re employed

Your P45s if you’ve left employment

Any interest certificates received on deposits

Your bank statements

Information on any personal pension contributions

Information on any dividends you’ve received

Information on any property income you’ve received

2. Next find your Unique Taxpayer Reference (UTR) that you safely stored away when you enrolled for the online service and activate your account

3. Sign in, there are a few ways to do this – if you’ve misplaced your UTR you can sign in using gov.uk

4. There are several sections to complete, some or all might be relevant to you, again it depends on what income and expenses you’ve had during that year. Sections include:

Employment

Self-employment – this is where your business record-keeping comes in handy

Partnerships

UK property

Foreign – such as income or interest from overseas

Trusts

Capital gains

Residence and remittance

Additional income, such as interest or dividends

5. Once you’ve navigated through the return, HMRC will calculate an indicative view of the tax you owe which will be validated – this can take a few days.

If you’re submitting online returns, make sure you submit your return by midnight on 31 January latest. This will also be the date your first payment is due.

Tax returns can seem incredibly scary and complicated, and while a Self Assessment return has a lot of sections, not every section might apply to your business. So take your time to go through and understand what applies to your personal and business circumstances.

If you’re diligent about recording income and expenses throughout the year, and saving these records so they are accessible, it should make the end-of-year process much simpler.

This blog was first published on 12 November 2020

Disclaimer: The content of this blog is based on our understanding of the topic at the time of publication and should not be taken as professional advice. Any of the information may be subject to change. You are responsible for complying with tax law and if in doubt, should seek independent advice.