The way an investment scam generally plays out is that a scammer will get in touch via social media and advertise their ‘services’ to tempt you into starting a conversation with them. In almost every case, the scammer will offer very high rates of return over a short period of time. The problem is that there is actually no investment and once you send your money, you have very little chance of getting it back.

How do investment scams work?

Sadly, they are very simple. You are made to think and feel that the investment is genuine and you send your hard-earned money voluntarily to an account that is controlled by the scammer. Once any money has been sent, there’s very little you can do to get it back.

Why do people fall for these types of scam?

The scammers can be incredibly convincing and will often use details they’ve gathered from your own social media accounts such as Facebook or LinkedIn. They offer deals that promise huge returns over short periods of time, for example guaranteeing ‘500% returns in months’ and they tend to give their ‘investments’ legitimate sounding names (think of 3 surnames, remove the spaces and, voila, an investment vehicle sounds plausible).

Unfortunately, once people have fallen victim to this type of scam there are lots of cases where victims are defrauded a second or third time by paying ‘fees’ to release the profits on the nonexistent investment.

How to spot an investment scam?

The most common method that scammers use is approaching you directly or advertising on social media and promising high rates of return in a short space of time.

The easiest way to spot an investment scam is that it sounds too good to be true - even the best hedge funds would only ever get you around a 10% return. So if it sounds too good to be true then it usually is!

If you do end up engaging, then the scammer will tend to ask you to move money quickly and once you have done so they move you away from the original channel to, for example, the WhatsApp messenger app. If this happens then ask yourself why? What legitimate investment business would ever use a social media messenger app as a method of communication with its customers?

Ask questions! The scammers will rarely go into details about what you are actually investing. Ask for names and addresses, ask who regulates the company - anything that allows you to check what the person is saying with an independent body is always useful.

Finally, take your time. Do not give in to the pressure that you will be put under by the scammer to move quickly - they know that the less time you have to think about the investment the greater their chances are of getting your money. They will play on your emotions (though we won’t like to admit it we all like the idea of a bargain or getting something for nothing) and the scammers know this. Take your time, think things through and do some research.

On that final point, the scammers will sometimes have what looks like very legitimate websites or social media pages with lots of followers — so be careful and check out reviews from independent sources like the Prudential Regulation Authority (PRA) who regulate investment firms.

How to protect yourself from Investment scams (a quick reference guide!):

1. Be cautious where you’re approached by an investor on social media — it is highly unusual for a reputable and authorised investment firm/brokers to conduct their business through social media.

2. Remember, if it sounds too good to be true, it probably is (no more so, than in 2020!) — investing your money will always carry a risk, even with the most legitimate investments, and therefore, there is a chance with every investment that you won’t get your money back. Fraudsters claim profits are guaranteed, and that the investment is foolproof. Therefore, be very wary of any investor who makes a claim like this as it’s likely it will be a scam.

3. Question who you are talking to and take your time — remember it’s easy for people to know basic details about you. As well as faking phone numbers, email addresses and names. A person or organisation you trust will never rush you, stop you from seeking guidance from friends or family, or force you to do something on the spot (like transfer money, or opening a new account). If someone is doing this, then tell them you’ll think about it, hang up and speak directly with us using your known contact details.

4. Do plenty of research before ever sending any money — always check if the firm is authorised by the Financial Conduct Authority (FCA) and use their Warning List on potential investment opportunities.

If you are worried or know that you have been a victim of an investment scam...

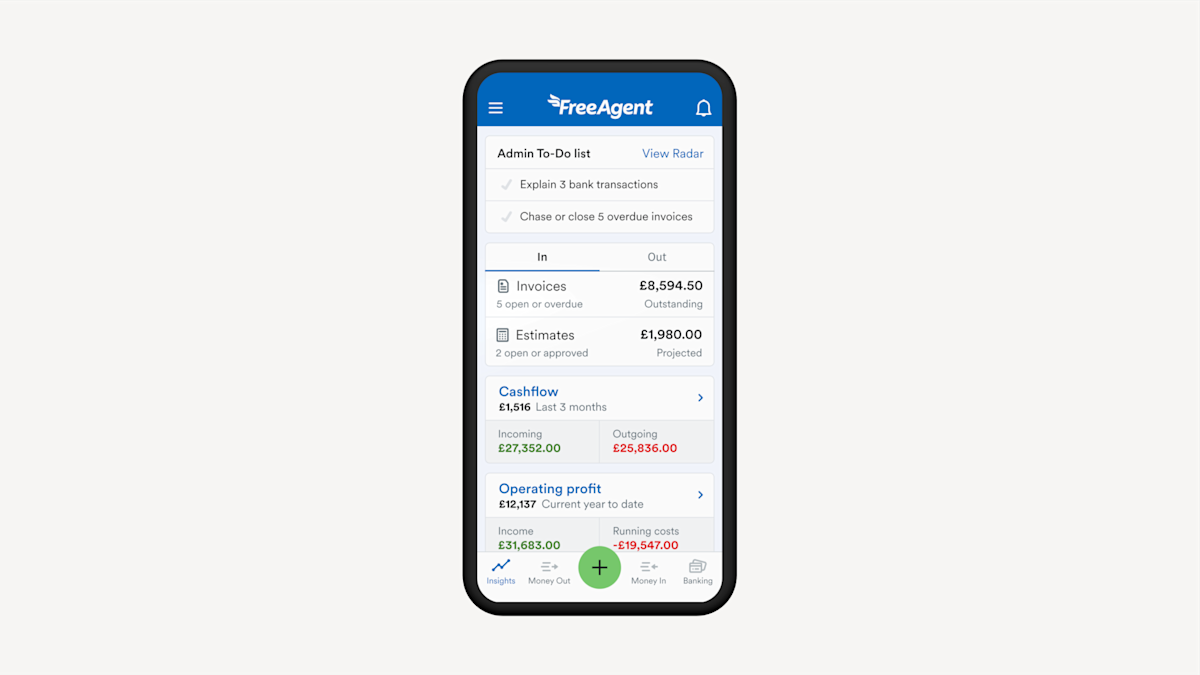

Get in touch with our customer support team at support@mettle.co.uk or via in-app message, or use the number on the back of your card, straight away. We will try and help by reaching out to the bank where you sent the money, to see if it is still in the account

Report what happened to Action Fraud https://www.actionfraud.police.uk/ or call 0300 123 2040 or use their online form https://reporting.actionfraud.police.uk/login

If you were scammed by a company, as opposed to an individual person, then you can also report this to the FCA https://www.fca.org.uk/