After a number of tax changes and U-turns earlier this year, the Chancellor of the Exchequer, Jeremy Hunt, was expected to announce even more in his first Autumn Statement – which he did. We’ve rounded up all the changes that could impact your small business.

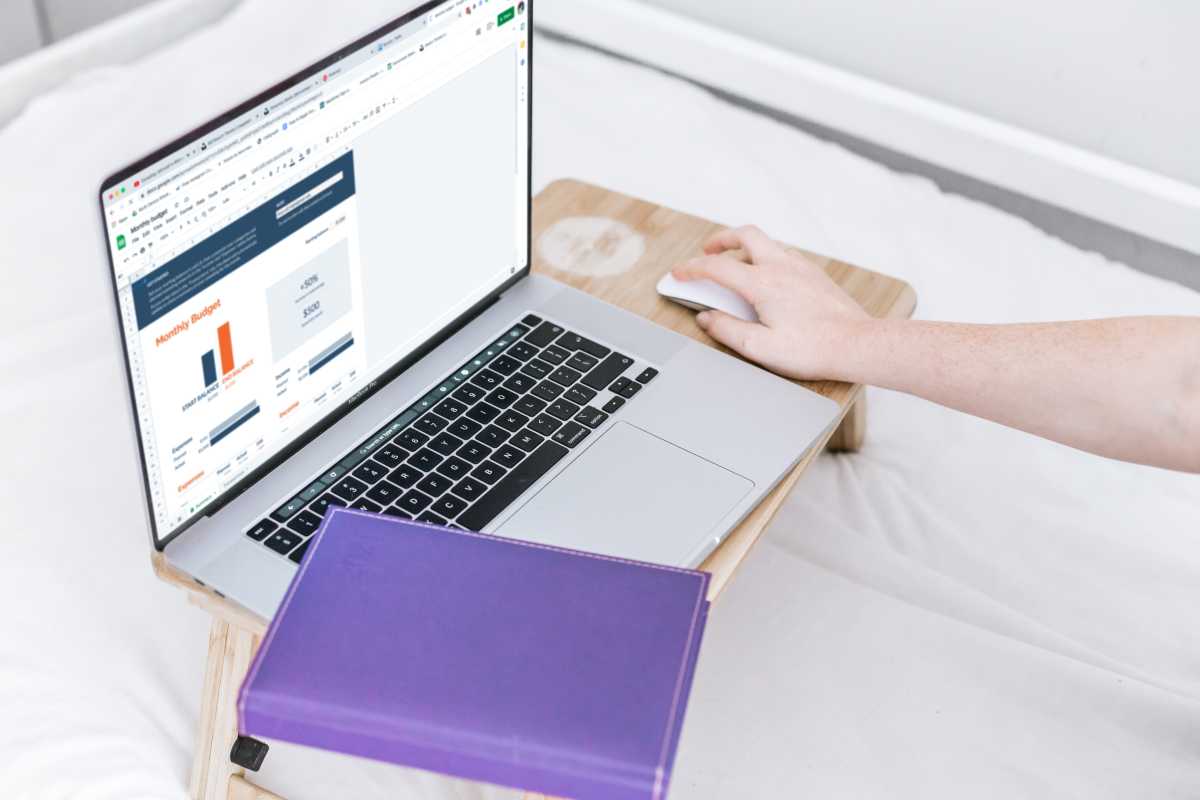

What are the headline changes?

The Chancellor announced changes to tax and spending that will have an impact on small businesses. For starters, Income Tax, Higher rate threshold, Main National Insurance thresholds and Inheritance Tax thresholds are frozen for a further two years until April 2028.

The government’s own forecasts are that 70% of actively trading limited companies will not see an increase in Corporation Tax next year due to the small profits rate being aligned to where it currently is.

It also indicates 40% of employers will not be affected by decisions on the threshold for Employers' National Insurance, with the aim being for larger employers to pay more. This should be positive for smaller businesses overall.

Other changes include:

National Living Wage for people over 23 to rise to £10.42 from April 2023 – this is an annual pay rise worth over £1600 to a full-time worker

National Insurance (NI) Secondary Threshold for Employers to remain at £9,100 until April 2028

VAT threshold to remain as it is until April 2024

Income Tax, higher rate threshold, main NI thresholds and Inheritance Tax thresholds are frozen for a further two years until April 2028

Employers' National Insurance Contributions threshold is frozen until April 2028 and Employers' Allowance at £5,000 until March 2026

The dividend allowance will be cut from £2,000 to £1,000 for April 2023 and then to £500 from April 2024

The annual exemption amount for Capital Gains tax will be cut from £12,300 to £6,000 next year and then again to £3,000 from April 2024

Reduced threshold for 45p tax rate from £150,000 to £125,140

From April 2025, Electric Vehicles will no longer be exempt from Vehicle Excise Duty

Freeze on Business rates for many next year – an estimated two-thirds of properties will not see an increase

R&D reliefs to be reformed, ongoing review by the government to reduce fraud and error

SME’s deduction rate was cut to 86% and credit rate to 10% but the increase on the rate of separate R&D expenditure credit was from 13% to 20%

Non-tax related changes

But that wasn’t all the Chancellor announced. The Energy Bill aid for households will be extended for another year, but the average annual bill will increase from £2,500 to £3,000. This means there will be around £500 in additional support for households.

There will also be additional cost of living payments next year of £900 to those on means-tested benefits, £300 to pensioner households and £150 for those individuals on disability benefits. Over 600,000 more people on Universal Credit will be forced to meet with work coaches with the aim of getting more people into the workforce with better-paid jobs.

As Britain slides into recession, the cuts to public services and increase in taxation were to be expected but seeing as though a lot of the changes announced today are loaded towards the future, it may well be that following the next election some of these measures could still change significantly.

You can find out more about Sidekick here or connect on Facebook, Twitter and LinkedIn.

Disclaimer: The content of this blog is based on our understanding of the topic at the time of publication and should not be taken as professional advice. Any of the information may be subject to change. You are responsible for complying with tax law and if in doubt, should seek independent advice.