Business bank account

With features around getting paid faster and managing your tax, Mettle is the account that helps you do your business finances on the go.

Kickstart your business

Bank with the winner of the Best Business Banking Provider at the British Bank Awards 2025.

Secure

Eligible funds protected up to £120,000 by the Financial Services Compensation Scheme (FSCS)

*Only savings pots can earn interest. You can only have one savings pot. Savings pots have a maximum balance of £1m. The interest rates may change to reflect the savings market. Interest is calculated daily and will be paid out monthly. Any positive change in interest will be notified within 30 days, any negative change in interest will be notified at least 60 days before. AER stands for Annual Equivalent Rate. It shows you what the rate would be if interest was paid and compounded each year. Gross is the interest rate you’ve paid without the deduction of UK income tax. p.a is per annum (per year). Read the full Mettle business account T&Cs here.

Accounting

Get FreeAgent included* with your Mettle account or sync with other accounting software like Xero and Quickbooks

*To get FreeAgent included, all you have to do is make at least one transaction a month from your Mettle account. If you don’t make one transaction a month, or if your Mettle account is closed and you continue to use FreeAgent then the FreeAgent fees will apply. FreeAgent has optional paid-for add ons that may be chargeable. Find out more here.

Built for the self-employed

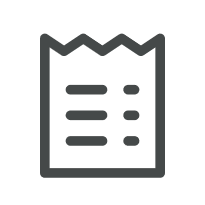

Simplified bookkeeping

Easily stay on top of business admin by ticking off bookkeeping tasks as you complete them.

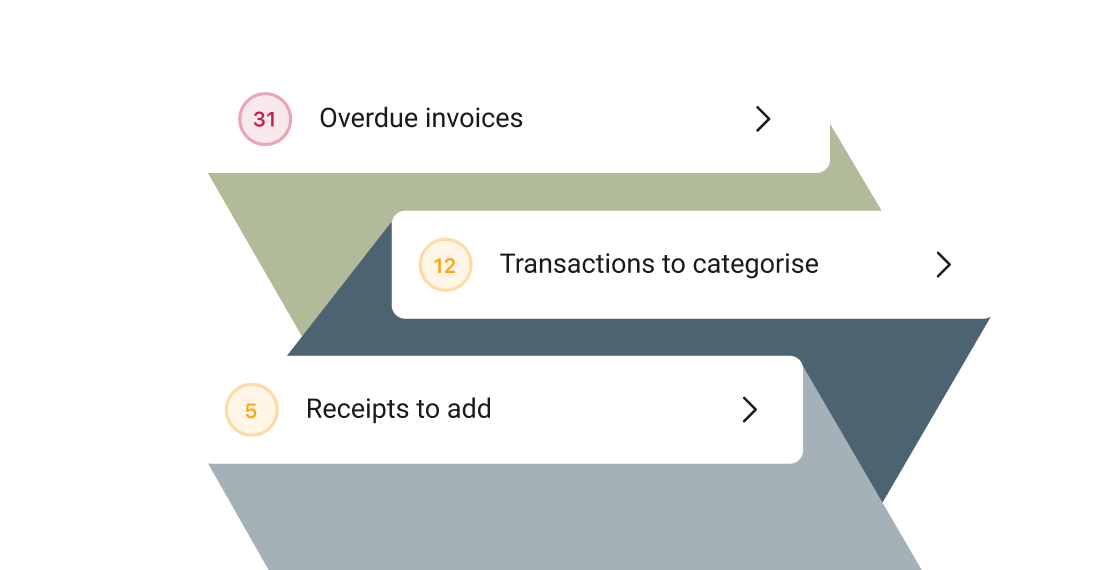

Upload receipts

Snap a picture or upload a PDF to your transactions, so your records are always up to date.

Business on the go

Doing business on the go has never been easier. Make customisable invoices, send and receive payments, or check your tax calculation from wherever you are.

Autosave for tax

Take the hassle out of saving for tax by automatically putting aside a percentage of every incoming payment into a tax pot.

Get paid faster

Manage your entire payment cycle – from creating an invoice to keeping your books up to date by categorising transactions.

Mettle's features

Features | Mettle account |

|---|---|

Customisable invoices | |

Sync with accounting software | |

Send invoices from your phone | |

View the status of your invoices | |

Reconcile multiple payments to an invoice or multiple invoices to a payment | |

FSCS protected | |

Google and Apple Pay | |

Cash deposits | |

Invoicing | |

Scheduled payments | |

Payment notifications | |

Upload receipts | |

Mettle on the web | |

Match payments to invoices | |

Direct Debits | |

Standing orders | Only on working days |

Automated Fuel Dispenser (AFD) transactions | |

Receive CHAPS payments | |

Help from real people |

Trusted by more than 100,000 self-starters

Sound good? Apply now

Have a quick look at our eligibility criteria.

- You’re a sole trader or limited company with up to two owners

- You have a balance limit of up to £1 million

- You’re a UK-based company with owners that are UK tax residents