Be tax confident

Bookkeeping has never been easier

Stay in control

Easily stay on top of your admin with a list of bookkeeping tasks you can mark off in the app as you complete them.

Upload receipts

Snap a picture or upload a PDF to your transactions, so your records are always up to date.

Get FreeAgent included

You'll save over £150 per year – based on the lowest tariff.*

Easy bookkeeping

Automatically sync categories and upload receipts to your FreeAgent account. Find out more here

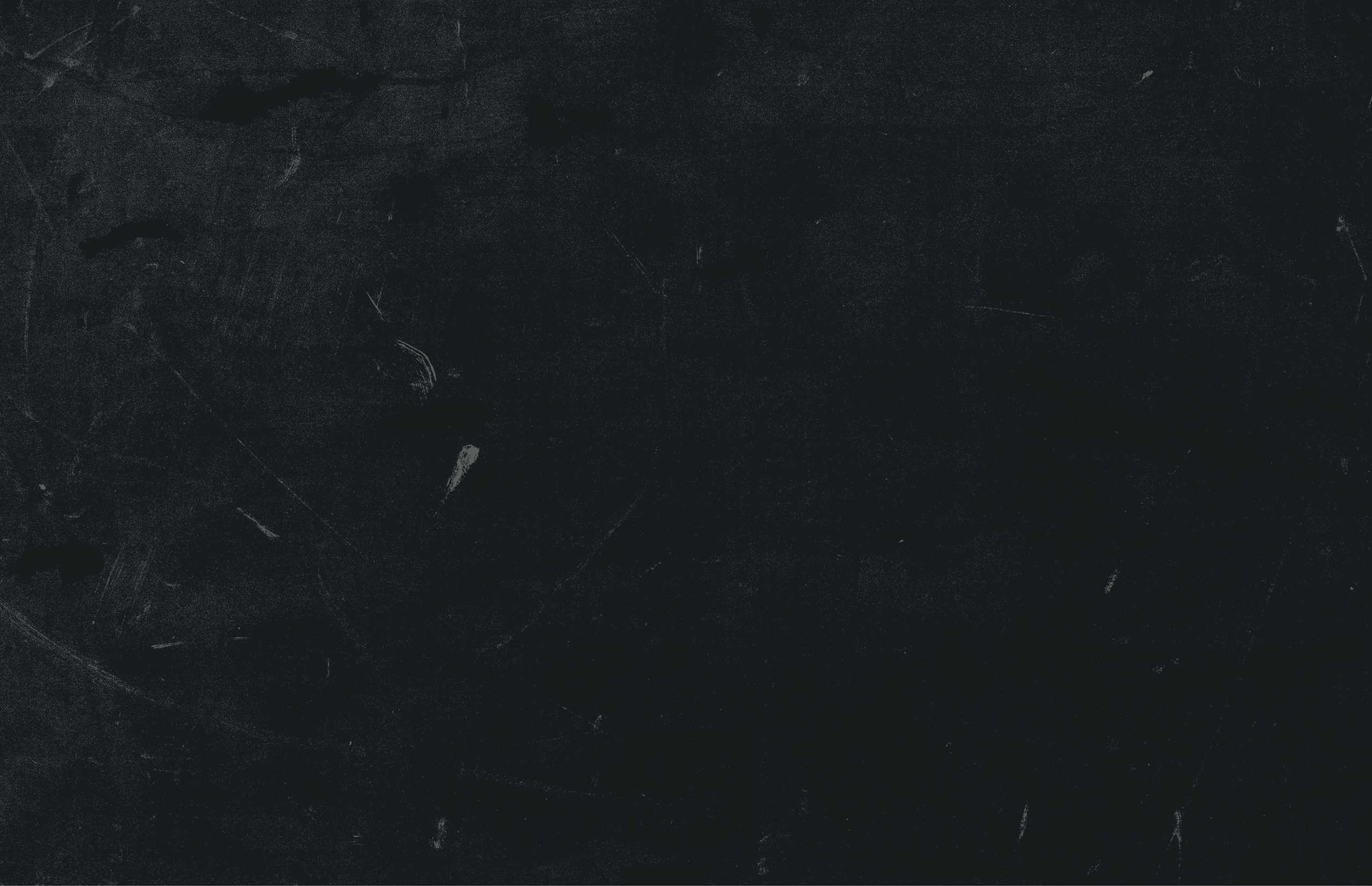

See what tax you're likely to owe

Get a running total of how much tax you owe and when you need to pay it in the Mettle app, powered by FreeAgent.

Automate your tax savings

Let Mettle do the heavy lifting by automatically saving for tax

Set up a ‘Tax Pot’

Choose a percentage you’d like to set aside each time you get paid

Let the app do the rest

Sync with accounting software

Automatically upload your transactions

You can set up a secure and real-time sync between your Mettle app and FreeAgent or Xero accounting software. Or connect to other accounting packages like Quickbooks.

Sync categories and receipts with FreeAgent

Easily upload your receipts to FreeAgent straight from your Mettle account. Find out how to connect to FreeAgent in our guide.

Download all your business transactions to share with your accountant

You can download all your receipts and invoices to share with your accountant. Whether in CSV, OFX, Excel or any format that’s compatible with your accounting software of choice

Sound good? Apply now

Have a quick look at our eligibility criteria.

- You’re a sole trader or limited company with up to two owners

- You have a balance limit of up to £1 million

- You’re a UK-based company with owners that are UK tax residents