How Mettle can support your accountancy practice

Mettle is a free business bank account by NatWest that’s built for contractors, freelancers and small businesses.

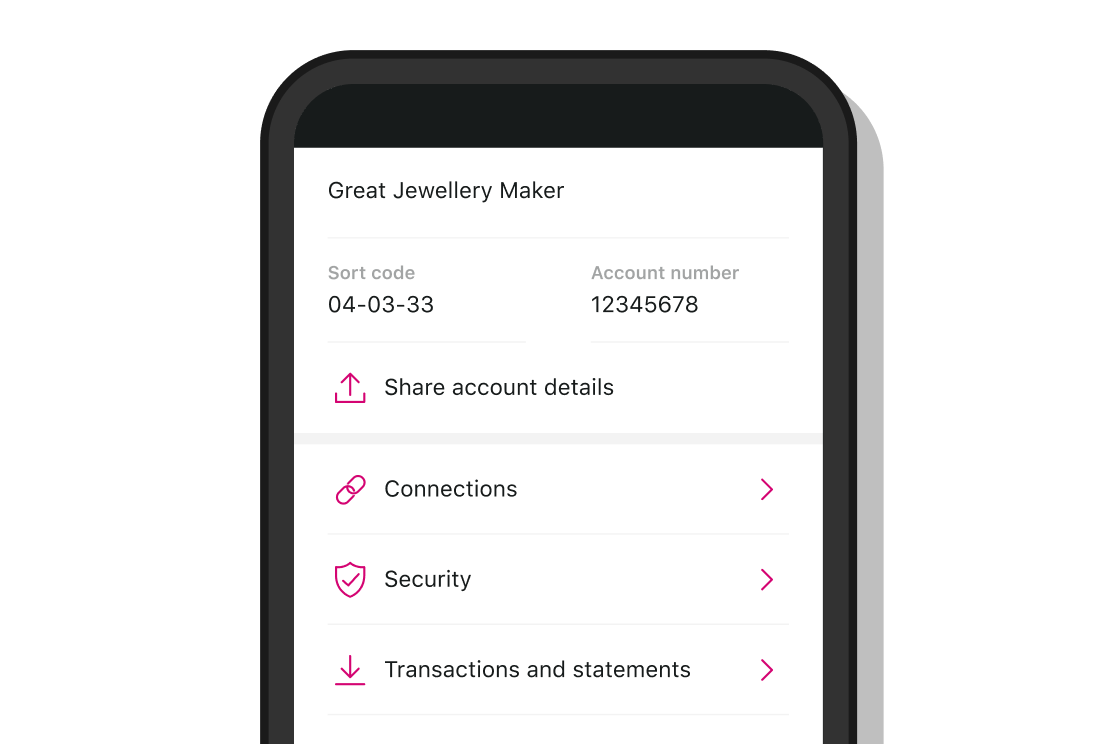

Key account information

Customers can apply for an account in minutes

The account comes with a UK account number and sort code.

Funds up to £120,000 are protected by the FSCS

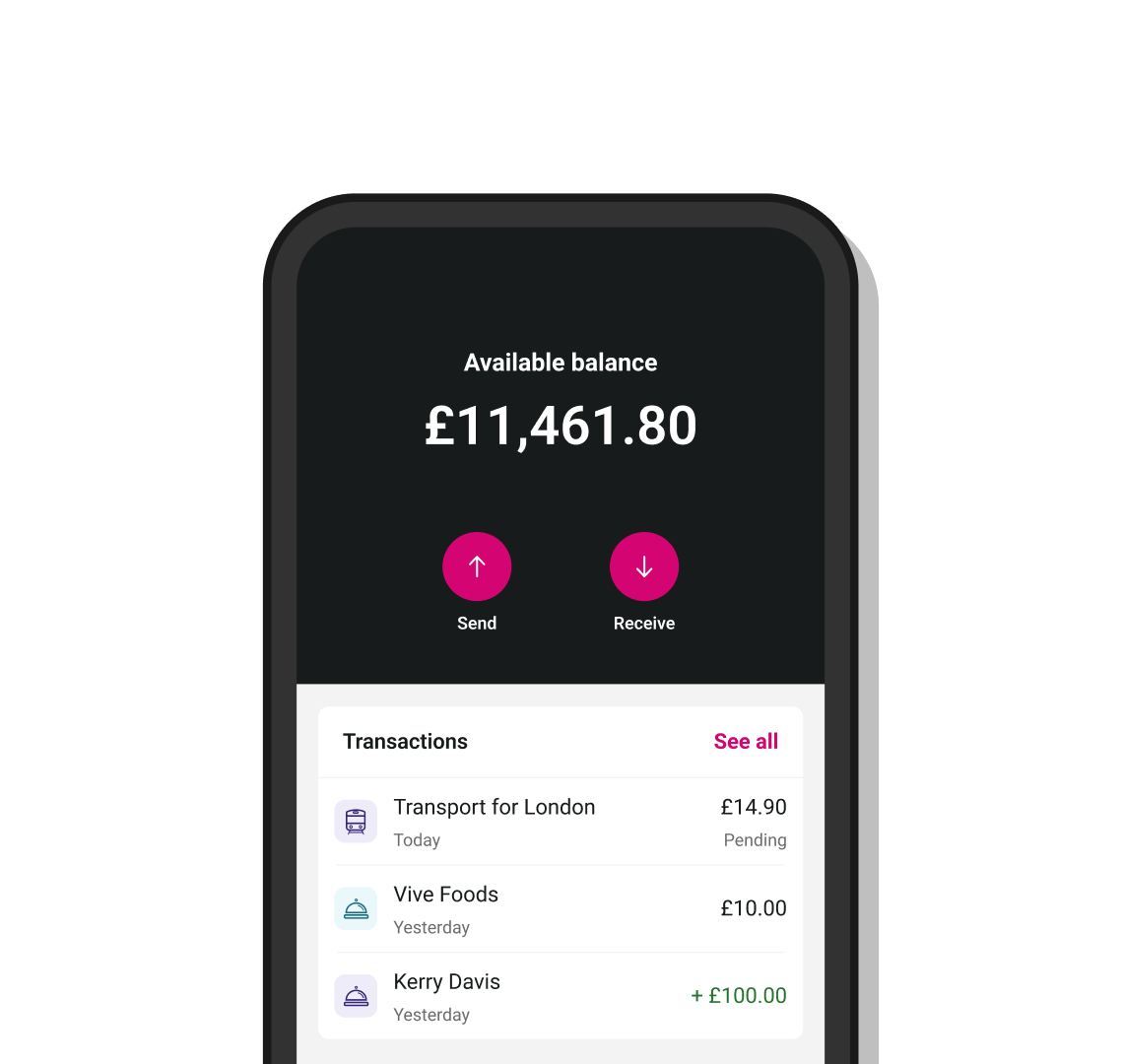

Account balances

Customers can have up to £1 million in their main account; £1 million in an interest bearing savings pot, and £100,000 across all other pots.

Account limitations

Mettle doesn't offer:

Lending facilities

International payments

Cheques

Eligibility exclusions

Mettle doesn't open accounts for:

Trusts

Clubs

Societies

Charities

LLPs

PLCs

Key features

Accounting software

Connect to accounting software to help keep track of their books.

Learn more about getting FreeAgent included with Mettle

*Conditions apply

Invoices

Create and send customised invoices all from their phone or desktop.

Tax calculation

Get a running total of much tax they're likely to owe in the Mettle app.

*To get FreeAgent included, you must make at least one transaction a month from your Mettle account. If you don’t make one transaction a month, or if your Mettle account is closed and you continue to use FreeAgent then the FreeAgent fees will apply. FreeAgent has optional paid-for add ons that may be chargeable.

Mettle+

Help customers win more business by creating quotes on the go and converting them to invoices for £4 a month.

*Mettle+ is an optional paid-for add-on.

Sound good? Apply now

Customers can apply easily from their phones

- They're s sole trader or limited company with up to two owners

- They have a balance of up to £1 million

- They're a UK based business with owners who are UK tax residents